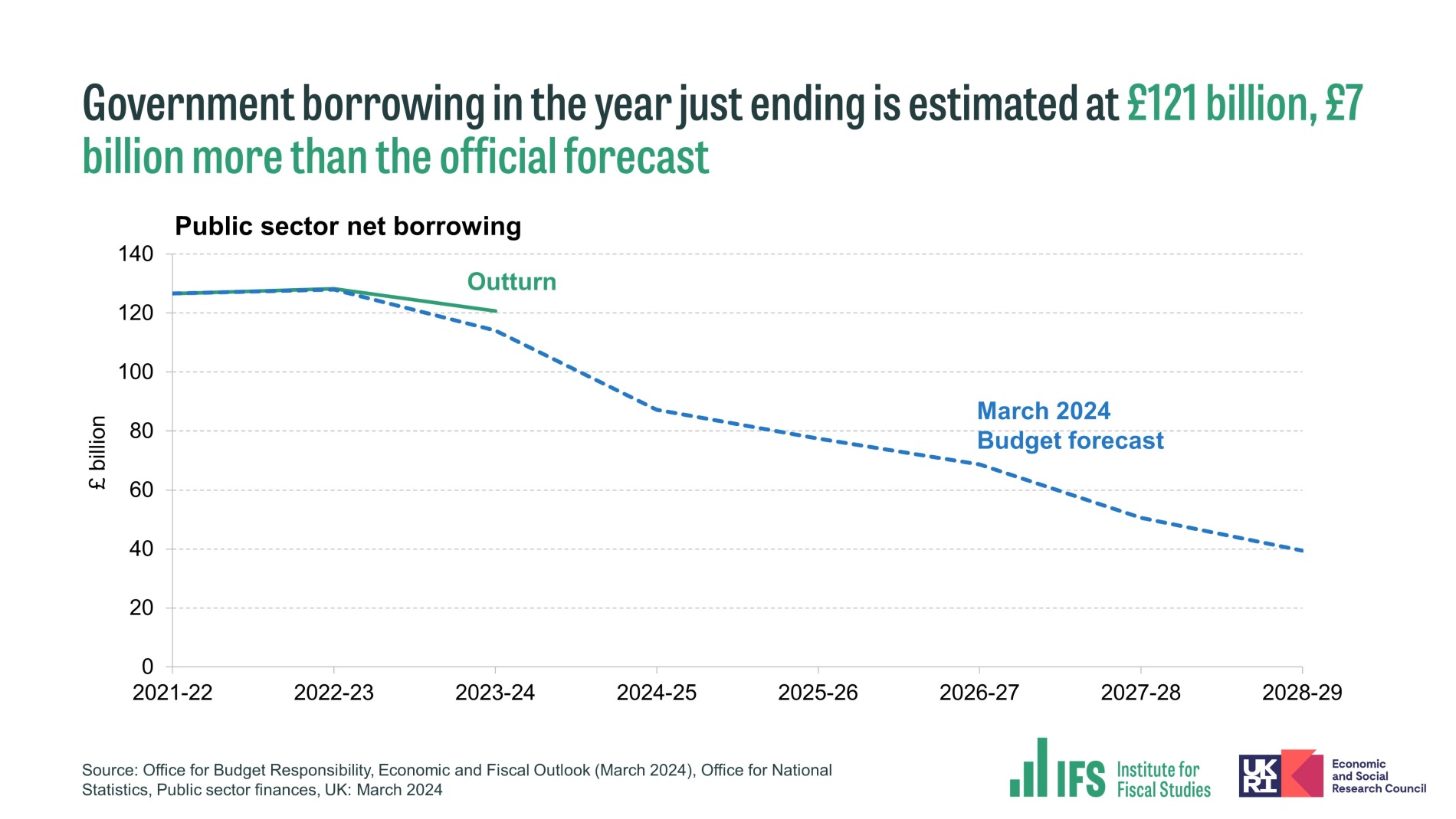

Public sector borrowing was £6.6bn higher than forecast by the Office for Budget Responsibility in 2023-24, according to figures released today by the Office for National Statistics.

Commentators said the numbers call into question chancellor Jeremy Hunt's ability to unveil further pre-election tax cuts. The provisional figures also put pressure on the funding expectations for government departments that Hunt set out in last month's Spring Budget.

According to the ONS, public sector borrowing – the difference between public sector income and spending – for the 2023-24 financial year is provisionally estimated at £120.7bn. While the figure is £7.7bn less than in 2022-23, it is £6.6bn more than the OBR had forecast.

Central government borrowing forms the largest element of public sector borrowing. Although 2023-24 income increased by £57.6bn to £997.7bn, this was offset by a £71.8bn increase in expenditure to £1,138.3bn.

The ONS said public sector net debt excluding debts of public sector banks was provisionally estimated at 98.3% of gross domestic product at the end of March. It said the figure was 2.6 percentage points more than at the end of March 2023, and "remains at levels last seen in the early 1960s".

Isabel Stockton, senior research economist at think tank the Institute for Fiscal Studies, said that although today's initial estimate of borrowing would be revised in the coming months, the implications were stark.

"Even if borrowing falls substantially over coming years, as under official forecasts, this would barely be enough to stabilise debt as a share of national income," she said.

Stockton said the situation represented a "difficult inheritance" for whoever is chancellor following the looming general election, which must take place by January 2025.

The IFS said the forecast fall in borrowing over the next five years was "predicated on tight spending plans and large tax rises". However it added that last year's initial public sector borrowing estimate had been subsequently revised down by 11%, and that the median revision to borrowing estimates over the past eight years was almost one-tenth of the total amount.

Nevertheless, in six of those years the latest-available estimate is higher than the initial estimate, according to the IFS.

Cara Pacitti, senior economist at family-focused think tank the Resolution Foundation, said "high-but-falling" inflation and rising interest rates had caused both spending and tax receipts to rise in 2023-24, compared to the year before.

Cara Pacitti, senior economist at family-focused think tank the Resolution Foundation, said "high-but-falling" inflation and rising interest rates had caused both spending and tax receipts to rise in 2023-24, compared to the year before.

Pacitti said the figures did not bode well for further taxation cuts before the general election.

“So far there are no signs of any new fiscal wriggle room emerging that might allow the chancellor to announce another pre-election budget in the autumn,” she said.

Ruth Gregory, deputy chief UK economist at consultancy Capital Economics, agreed the latest figures would be a disappointment to Hunt if he had been planning further "big tax cuts" in the coming months.

She said that rather than the £8.9bn of fiscal "headroom" left over from the Spring Budget, Hunt could now be looking at a figure closer to £5bn.